ATTENTION: AUSTRALIANS WHO WANT TO BUILD CONSISTENT INCOME, ACCESS ONE OF THE FASTEST GROWING ASSET CLASSES, AND ALIGN WITH LONG-TERM WEALTH GOALS, ALL WITHIN THEIR SUPER

Transform Your Super Into A Wealth-Aligned Growth Engine — Use Specialist SMSF Lending To Acquire Revenue-Generating Property — Leveraging Stable Growth, Consistent Rental Income And Long-Term Financial Confidence

…Without Drowning In Paperwork, Feeling Lost In SMSF Jargon, Or Getting Stuck In Compliance Overwhelm

✅Proven SMSF Lending Process ✅Trusted By Thousands Of Australians ✅Take Control Of Your Super

Unlock The Proven Process Smart Australians Use To Align Wealth Inside Their Super — Book Your Complimentary Discovery Call Today

...And Discover How To Access Specialist SMSF Lending, Acquire Income-Generating Property, And Take Control With A High-Growth Asset Class

We Build Powerful SMSF Property Investment Systems For You…

Implement The Exact SMSF Property Strategy Trusted By Professionals To Secure Income-Generating Assets And Retire With Confidence

Your super deserves more than guesswork — you need a proven, step-by-step system you can trust to transform your retirement savings into a stable property portfolio, without the confusion or overwhelm.

Here’s Exactly What We Build For You:

Your Personalised SMSF Property Strategy

We create a clear, step-by-step strategy tailored to your super fund borrowing capacity and property investment goals.

From understanding how property inside super works to mapping out exactly what’s possible with your current balance, this plan gives you the confidence and clarity to move forward without hesitation.

You’ll finally have a roadmap designed specifically for your circumstances.

Your Compliance-Ready Lending Solution

Access our network of specialist SMSF lenders who understand the complexities of superannuation property finance.

We handle the entire lending process, from sourcing competitive rates to preparing all required documentation.

This ensures your loan is structured correctly and fully compliant, so you avoid costly mistakes and delays.

Your Seamless Property Acquisition Process

We have access to all the SMSF experts you need on your team to facilitate setting up the fund (if required), providing financial advice, and once ready, researching and negotiating on the right property to suit your needs.

We work together to coordinate every detail of the property purchase, from due diligence through to settlement, every step is managed for you.

This eliminates overwhelm and ensures your SMSF investment is executed smoothly, securely, and in line with your long-term wealth plan.

Your Ongoing Compliance & Support Framework

Once your property is secured, we don’t disappear.

You get continuous support to keep your SMSF compliant and optimised.

From annual reviews to ongoing guidance on contributions, repayments, and regulations, we make sure your investment stays on track—giving you complete peace of mind year after year.

Planning Your Next Move With Confidence

We help you understand how property inside your SMSF could support your long-term financial goals.

By showing you how rental income and potential capital growth work within a fund structure, you’ll gain clarity on what’s possible—without needing to rely solely on shares or traditional super fund performance.

This isn’t financial advice—it’s about giving you the tools and education to make confident, informed decisions around your SMSF investment path.

Your Property Investment Success Starts With The Right Finance Strategy—And We Build It For You.

From the Desk of

Alyssa Russo

Principal Broker, Edgewater Finance

SMSF Investment Lending Specialist

The biggest problem professionals and business owners face when trying to grow their wealth inside super?

Overwhelm and uncertainty.

With so many conflicting opinions about SMSFs and property, it’s incredibly difficult to know who to trust or where to begin. Over the years, I’ve seen it time and again…

A couple decides to take control of their super, reads countless articles, speaks to general brokers who don’t specialise in SMSF loans—and ends up paralysed by complexity.

Months pass, and instead of moving forward, they stay stuck with a volatile share portfolio and no clear path to build lasting wealth.

The reality? It’s not your fault.

If you’ve spent any time researching SMSF property investing, you’ll know everyone has a “simple solution”—but no one shows you how to navigate the rules confidently, secure the right loan, and actually execute a compliant purchase from start to finish.

Right?

They never solve the root of the problem—most Australians don’t have the time or expertise to piece all the moving parts together on their own.

From structuring your fund and strategy…

To sourcing compliant lenders and negotiating the right finance…

To handling paperwork, settlement, and ongoing compliance…

That’s where we are different.

We understand SMSF property investing inside out.

We know exactly how to create a tailored, step-by-step plan that eliminates confusion and gives you total clarity.

We know how to manage the entire process so you can invest confidently, knowing your wealth is working harder for your future—without the stress or uncertainty.

"We Take This Powerful SMSF Property Investment Process and Build It Around Your Goals, For You"

You don’t have to figure out every regulation, lender requirement, or compliance detail yourself. SMSF property investment is our area of expertise.

Having guided so many Australians through this exact journey, we know precisely what works—and what causes costly setbacks.

We’ve developed proven processes to help you secure the right property, structure your finance correctly, and stay compliant at every step.

You could spend months trying to piece it all together, risking mistakes that could derail your retirement plans.

Or you could shortcut the entire process by partnering with specialists who know exactly how to turn your super into a stable, income-generating property asset—without the confusion or overwhelm.

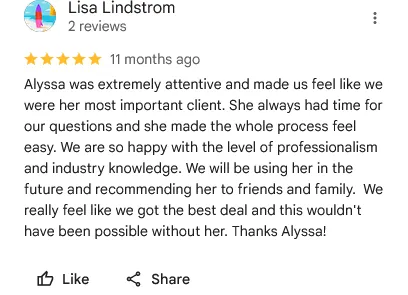

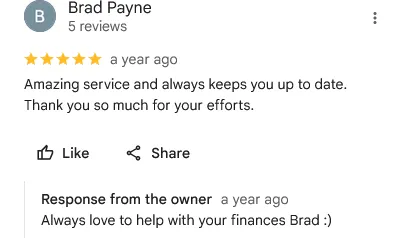

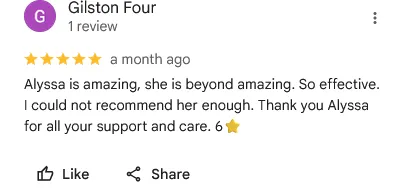

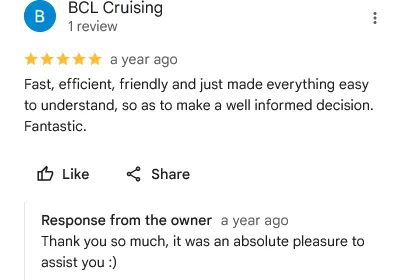

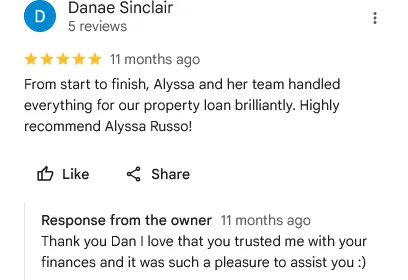

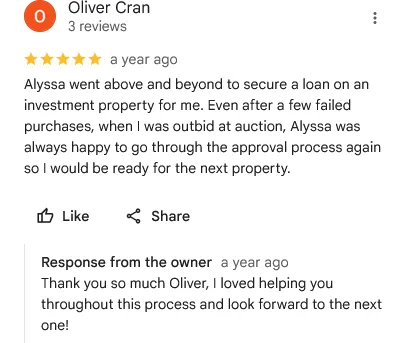

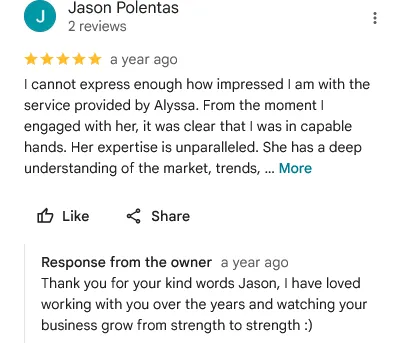

But Don't Just Take Our Word For It....

Execution Case Studies

Secured A $650,000 SMSF Investment Property And Achieved Strong Rental Yield In Under 90 Days

This professional couple had a combined super balance of just over $300,000 and were frustrated by years of inconsistent returns in traditional super funds.

We worked closely with them to develop a tailored SMSF property strategy, referred them to one of our expert SMSF Buyer's Agents to find a compliant residential property, and secure finance through one of our specialist lenders.

Within 90 days, they had purchased a $650,000 property generating rental income inside their super. We handled the entire process end to end—strategy, compliance, lending, purchase coordination—so they felt confident and in control from day one.

Today, their fund receives consistent rental income and they have a clear plan to grow their portfolio further.

We Personally Use The Same SMSF Property Framework We Deliver To Our Clients

We practise what we preach. We have applied this exact process in our own SMSF to secure compliant investment property and build tax-advantaged wealth over the long term.

From mapping the strategy to liaising with lenders and completing due diligence, we’ve experienced every step of the process ourselves. This is why we know precisely how to avoid the pitfalls that derail most investors.

When you book your Discovery Call, we’ll show you exactly how this proven system works in real life—including our own numbers, lessons learned, and the long-term benefits we continue to enjoy.

"Secure Income-Generating Property Inside Your Super With A Proven, Compliance-Ready System Built For You"

The key to growing your retirement wealth is a clear, structured SMSF property strategy. Leverage a proven end-to-end system deployed for you in just 30 days.

We remove all the guesswork and deliver the exact process that has helped Australian professionals confidently invest their super into property—without stress, confusion, or costly mistakes.

Learn How To Transform Your Super Into A Reliable, Income-Generating Property Asset

Take control of your financial future by leveraging a proven SMSF property strategy that empowers you to secure compliant loans, purchase high-quality investment property, and build long-term wealth

....without the confusion, overwhelm, or risk of costly mistakes.

The Proven SMSF Property Investment Process

Clarity & Vision

The first step is understanding exactly what you want your financial future to look like.

We work with you to define clear goals and show you how investing in property through your SMSF can help achieve them.

This clarity becomes the foundation for every decision you make.

Strategy & Confidence

Once your vision is clear, we develop a tailored, step-by-step strategy.

You’ll see precisely what’s possible with your current super balance and how to structure your investment safely and compliantly.

This removes uncertainty and gives you total confidence to move forward.

Guided Action & Referral

We bring in all required SMSF investment specialists and work together in handling all the paperwork, lender negotiations, compliance requirements and property negotiations on your behalf.

You stay focused on your goals while we take care of the details, ensuring nothing is overlooked and every step runs smoothly.

Seamless Purchase

When you’re ready to buy, your property negotiator will coordinate the entire acquisition process—from due diligence and contracts through to settlement.

This ensures your property purchase is stress-free and fully aligned with your long-term wealth plan.

Ongoing Support & Compliance

After settlement, you have a trusted partner on hand to keep your SMSF investment compliant and optimised.

We provide continuous guidance and reviews so your strategy stays on track and your retirement wealth grows confidently over time.

Client Results:

Check Out Some Feedback Provided By Our Clients...

Frequently Asked Questions:

How much super do I need to get started with SMSF property investing?

Most clients start with a combined super balance of at least $200,000. This provides enough capital to cover the deposit, legal costs, and setup while still maintaining liquidity for compliance requirements.

Is an SMSF property strategy only suitable for wealthy investors?

No. Many Australians mistakenly believe SMSFs are only for the very wealthy. In reality, if you have a combined balance of $200,000 or more, you may be well positioned to begin building wealth through property in your super.

Will I have to manage all the paperwork and compliance myself?

Absolutely not. Together with our trusted partners, we will handle the entire process for you—from structuring your fund and securing finance to coordinating the purchase and ongoing compliance. You’ll have a specialist partner guiding you every step of the way.

Can my SMSF purchase any type of property?

No. The property must meet strict rules set by the ATO. It needs to be for investment purposes only (not for personal use) and purchased at market value from an unrelated party. We’ll ensure every detail is compliant.

What if I already have an SMSF set up?

That’s perfectly fine. We can assess your current SMSF structure and help you develop a tailored property investment strategy, or support you in securing finance and executing a compliant purchase.

How does the loan process work for SMSFs?

SMSF loans are known as Limited Recourse Borrowing Arrangements (LRBAs). We work with specialist lenders who understand SMSF lending rules and can provide terms that align with your strategy. We’ll manage the process end-to-end.

How long does the entire process take?

Typically, from initial strategy session to settlement, the process takes around 60–90 days. This includes time for structuring, approvals, finance, due diligence, and settlement.

What ongoing support will I receive after settlement?

You’ll have continuous support to ensure your SMSF remains compliant and optimised. We provide annual reviews, guidance on contributions and repayments, and help you plan the next stages of your property strategy.

Is there a risk of losing my super if the property doesn’t perform?

Like any investment, property carries risks. However, with a clear strategy, careful due diligence, and professional guidance, you can significantly reduce unnecessary risk and make informed decisions aligned with your retirement goals.

What makes your service different from other brokers or advisers?

We specialise exclusively in SMSF property finance and investing. Unlike general brokers, we understand every nuance of SMSF compliance, lending, and strategy. With our end-to-end support, you’ll never feel overwhelmed or uncertain—just clear, confident, and in control of your wealth-building journey.

Ready To Unlock The Proven Strategies Smart Australians Use To Build Wealth Inside Their Super?

© Copyright 2025 Edgewater Finance. All rights reserved.

Reproduction or duplication of this website or contents is strictly prohibited.

View Privacy Policy & Terms

Disclaimer: Information provided in this presentation is general in nature and does not constitute personal financial advice. Every effort has been made to ensure that the information provided is accurate. You must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you make an appointment with one of our finance professionals to take into account your particular investment objectives, financial situation and individual needs. We always recommend speaking to your accountant or tax adviser before acting on tax matters. Unless otherwise specified, copyright of information provided in this presentation is owned by Edgewater Finance. You may not alter or modify this information in any way, including the removal of this copyright notice.